EOI – VC/ S015/ 200/ 202002001

June 20, 2021

EOI – VC/ S015/ 200/ 202002001

June 20, 2021What is Members’ Voluntary Liquidation?

Members’ Voluntary Liquidation or Members’ Voluntary Winding-up (“MVL”) is one of the modes of winding-up available.

MVL is a process to formally close down a company which is solvent and has sufficient liquid funds available to meet its liabilities including the fees, cost and expenses of liquidation.

A company which is solvent means it is able to pay all its debts in full within a period not exceeding 12 months.

How to place a company in Members’ Voluntary Liquidation?

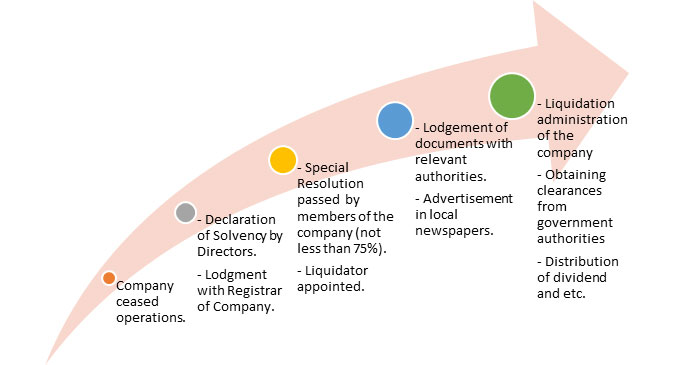

Directors to make a Declaration of Solvency

Directors of the company to make statutory declaration that they have made an inquiry into the affairs of the company, and that at a meeting of directors, the directors formed an opinion in the Declaration of Solvency that the company will be able to pay its debts in full within a period not exceeding twelve months after the commencement of the winding-up.

General Meeting to pass Special Resolution for Members’ Voluntary Liquidation

A general meeting is required to be convened to pass a special resolution to wind-up the company. A special resolution needs to be passed by not less than 75% of the members who are entitled to vote.

Procedure of a Members’ Voluntary Liquidation

Circumstances for a company be placed into Members Voluntary Liquidation

Some of the reasons why a company decided to be wound-up via MVL are as below:

- The company is looking to cease business or the business owner is looking at retiring. This may be an appropriate exit strategy as the shareholders would be able to get their capital return together with any dividend distribution (if any).

- There is dispute among shareholders, or the shareholders aim and directions have changed or no longer able to work together for the same objective., In this case, it may be best to liquidate the company.

MVL is also more often than not be used as a restructuring tool for a group or corporation to close down non-performing subsidiaries or units.

Section 439 of the Companies Act provides that a company may be wound-up voluntarily:

a) when the period, if any, fixed by the constitution expires; or

b) the event, if any occurs, on the occurrence of which the constitution provide that the company is to be dissolved and the company in a general meeting has passed a resolution requiring the company to be wound-up voluntarily; or

c) The company so resolves by special resolution.

What is the effect of Members’ Voluntary Liquidation?

The powers of the directors cease unless the liquidator or the company in general meeting with the consent of the liquidator approves the continuance of those powers pursuant to Section 445(2) of the Companies Act.

Pursuant to Section 442(1) of the Companies Act, the company shall cease to carry on its business from the commencement of the winding-up except so far as is required in the opinion of the liquidator for the beneficial winding-up thereof.

Any transfer of shares, except for transfer made to or with the sanction of the liquidator and any alterations in the status of members, made after the commencement of the winding-up, shall be void.

What happens during the MVL administration?

The Liquidator appointed will administer the MVL process which include taking control of the company and its assets, settlement of creditors, obtaining necessary clearances from the authorities, distributing of surplus funds and etc.

The difference between Creditors’ Voluntary Liquidation & Members’ Voluntary Liquidation?

A Members’ Voluntary Liquidation is where the company is solvent and declaration of solvency is made by the Directors while a Creditors’ Voluntary Liquidation is where the company is insolvent and declaration of insolvency is made by the Directors.

What is the timeline to complete MVL?

Depending on the circumstances of each case, the overall timeframe for MVL varies. Kindly contact us to discuss further.

Our other article on options to closed down a company:

If your company is insolvent, you want to find out the voluntary option available here.

How can VCCA assist?

VC CORPORATE ADVISORY (“VCCA”) is a member firm of Malaysian Institute of Accountants (“MIA”) and our partners are licensed insolvency practitioners approved by the Ministry of Finance.

Together with our team of experienced chartered accountants, VCCA work and liaise with various professionals such as lawyers, banks and financial institutions, government authorities and other related professionals to achieve the best possible solution and highest recovery for all stakeholders throughout the insolvency, restructuring, receivership or corporate rescue process.

Our team of highly qualified professionals has worked throughout various industries & assisted numerous companies in financial distress and would be able to assist you.

For more information call us at +603-6734 9838 or email us at info@vcca.my.

Follow us on: